What Is an Auto Insurance Score?

An auto insurance score is a number used by insurance companies to determine your premiums. It’s calculated based on information in your credit report to predict the likelihood of you filing a claim.

How Is It Calculated?

Insurance companies use complex algorithms to analyze factors like:

1. Your payment history:

Do you pay bills on time? Late or missed payments lower your score.

2. Credit balances:

High balances on credit cards or loans relative to your limits may indicate higher risk.

3. Length of credit history

A longer credit history with a mix of accounts in good standing boosts your score.

4. New credit inquiries:

Applying for a lot of new credit quickly can lower your score.

5. Credit mix:

Having a good mix of credit cards, installment loans, finance company accounts, etc. improves your score.

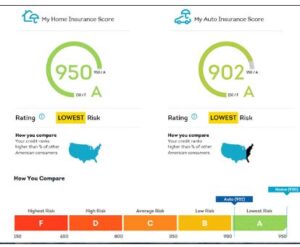

The scores typically range from 200 to 900. A higher score means you’re less risky and qualify for lower premiums. Scores around 700 or above are usually considered good.

See this: How To Earn Online Criminal Justice Degree Programs

How to Improve Your Score

The good news is there are steps you can take to improve your auto insurance score over time:

- Pay bills on time: Payment history is the biggest factor.

- Lower your credit card balances: Keep balances at 30% or less of your limits.

- Limit new applications: Only apply for new credit when needed.

- Check for errors: Dispute any incorrect information on your credit reports.

- If needed, you can ask your insurance company about ways to improve your score to potentially lower your premiums over the long run. Over time, maintaining good financial habits can really pay off

How Auto Insurance Companies Calculate Your Score

Auto insurance companies calculate your score based on a few key factors to determine your premiums.

They look at your driving record and history of claims. Things like speeding tickets, accidents, DUIs, etc. in your recent history can negatively impact your score. Multiple infractions or claims within a few years can really hurt your score and cause premiums to skyrocket.

They also consider your vehicle make, model, year, and mileage. Drivers of high-performance, luxury or sports cars typically pay more since those vehicles are seen as higher risk. Older vehicles with high mileage are also viewed as more prone to needing repairs, so they can lower your score.

Your credit score and report play a role too. Though controversial, studies show a correlation between low credit scores and higher claims. So companies use your credit information as an indicator of how responsible you are.

Finally, where you live impacts your auto insurance score. Areas with higher crime rates, traffic congestion or harsh weather conditions often lead to more frequent or severe claims, so companies charge higher premiums in those locations.

Tips for Improving Your Auto Insurance Score

To improve your auto insurance score and lower your premiums, here are a few tips:

Check your credit report regularly

Your credit score plays a role in your auto insurance score. Review your credit report from the three major bureaus Equifax, Experian and TransUnion at least once a year to check for any errors. Dispute them with the bureaus to get them corrected, which can help raise your score.

Maintain continuous coverage

Having a lapse in auto insurance coverage can lower your score significantly. Make sure you have continuous coverage for your vehicles to keep your score intact. If there is a lapse, get new coverage as soon as possible.

Consider bundling other policies

If you bundle your auto policy with other policies like home, renters or life insurance from the same company, you may be able to get a discount that also helps your auto insurance score. Check with your insurance provider about available bundling options and the potential savings.

Drive safely

Your driving record directly impacts your auto insurance score. Obey traffic laws, don’t get tickets and avoid accidents to keep a clean record. If you do get a ticket, take a defensive driving course to get it dismissed and avoid point penalties. Minor violations may stay on your record for 3 to 5 years, major ones for up to 10 years, so safe driving really pays off long-term.

Increase coverage limits

Higher liability limits can positively influence your auto insurance score. If your current limits seem low based on the value of vehicles and assets you need to protect, consider raising them. But only increase them as much as you can afford to pay for in higher premiums. Finding the right balance for your needs and budget is key.

Following these tips and making ongoing improvements to your credit and driving record over time can significantly boost your auto insurance score and save you money.

How a Poor Score Can Impact Your Rates

A poor auto insurance score can negatively impact your rates in the following ways.

Higher Rates

With a low score, insurance companies see you as a higher risk driver, so they charge you more to offset that risk. Your rates could increase by 50% or more compared to someone with an average score. The lower your score, the higher your rates are likely to climb.

Limited Choices

A poor score may limit which companies will insure you and the types of policies you qualify for. Some insurers may deny you coverage altogether based on a very low score. You’ll have fewer options to choose from, and may be stuck with higher-priced insurers that specialize in “non-standard” policies.

Difficulty Shopping Around

Insurance shopping requires getting quotes from multiple companies, but if your score is low, fewer insurers may provide you a quote. And the quotes you do get are likely to be much higher. This makes it difficult to find an affordable policy that fits your needs. You may feel like you have no choice but to go with a high-priced insurer, even if their service is lacking.

The impact of a poor score can be significant, but the good news is you can take steps to improve your score over time through safe driving practices and maintaining a good payment history.

Keep an eye on your score and check for errors. While improving your score is a process, keeping rates affordable in the meantime may require shopping carefully among higher-risk insurers or making changes to your policy limits.

Checking and Disputing Inaccuracies in Your Auto Insurance Score

Here are a few ways to check and dispute issues with your auto insurance score:

Request a free credit report

Since most insurance scores are based on information in your credit reports, review copies of your reports from the three major credit bureaus Equifax, Experian and TransUnion. Look for any errors like incorrect account information, accounts that don’t belong to you, or other red flags. Dispute these with the credit bureau to get them corrected.

Check for errors in your motor vehicle records

Insurance scores also factor in violations, accidents, and other details in your motor vehicle records (MVRs). Pull your own MVRs to look for any incorrect violations, lapses in coverage, or accidents that were not your fault. Work with your state’s department of motor vehicles to dispute and correct errors. Removing undeserved infractions can improve your score.

Contact your insurance company

In some cases, insurance companies use their own proprietary scores in addition to your credit-based score. Contact your insurer and request a copy of your score information, including factors used to calculate the score. Check for any incorrect information and provide documentation to dispute errors. Ask if lower premium rates may be available if errors are corrected.

File a complaint

If efforts to correct issues with your insurance score are unsuccessful, you may need to file a complaint with the Consumer Financial Protection Bureau regarding credit report errors or with your state insurance commissioner for insurance scoring errors. Provide details about the errors, copies of disputes, and responses to strengthen your complaint.

Conclusion

Monitoring and maintaining the accuracy of information used to calculate your auto insurance score is key to keeping premium costs under control. While the process can be time-consuming, the potential savings make it worthwhile. Staying on top of your scores and records will ensure you’re not paying more than you should for coverage.

Check Also;